Synthesis Adoption Series: What are the Key Milestones for Alternative Protein Adoption to Reach S-Curve Growth?

• Market Update • Opinion

The media have declared it. The business of plant-based meat is just a “passing fad”[i]. But, it appears plant-based meat is in illustrious company. Everything from the car[ii], internet[iii], radio[iv], women’s liberation[v] and even the iPhone (by some media declared a failure before it had even launched[vi]) has at one time been declared a fad.

Hindsight of course is a wonderful thing, and it is easy for us to chortle now at those in history who got it wrong. But let’s dig in a little deeper. Most of these headlines illustrated valid hurdles to technology adoption at the time they were written.

For example, in the early 1990s the internet was still just a newborn – its potential yet to be fully realised – and smartphones were a glint in the eye. Although the number of computers connected to the internet had passed one million[vii] globally, in the 1990s most of these connected computers were in schools, universities and businesses. Very few people were connected at home – and certainly not in their palm like we are today. Not to forget those first websites were crude by today’s standards – the Google search engine was still a prototype!

By the year 2000, consumers were apparently turning their backs on the internet because of frustrations with its limitations – it was slow and accessing it was expensive.[iii]The internet in its current form simply didn’t exist – and, crucially, neither did the way we use it. It is a good job we didn’t give up on it then!

Those media articles were bringing up important questions and controversies – completely valid at the time. For those of us deep in the alternative protein space, we know that the issues raised with the plant-based sector are real and valid. The good news is, at Synthesis we see the hundreds of companies and thousands of people working on solving these issues.

This is the beginning, not the end, of growth in alternative proteins

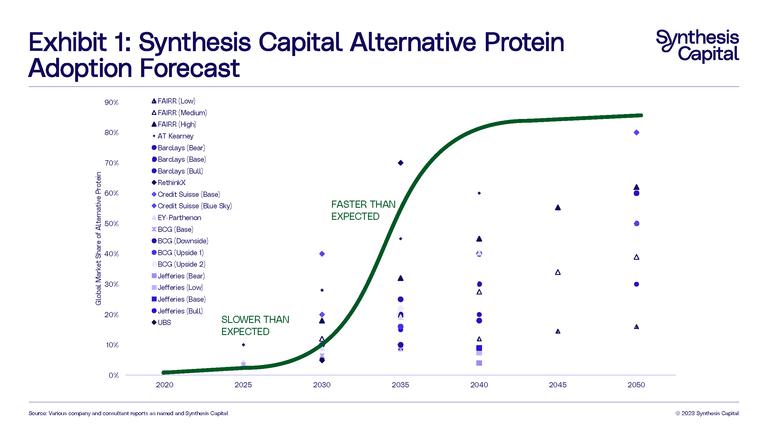

Remember we are still very early in this change. In our piece “S-Curve Adoption: Our House View on Alternative Protein Market Growth”, we showed our estimate for the market adoption of alternative protein.

While market share estimates are currently low, from 2027 onwards we believe that enough trigger points will come into play for adoption to start accelerating, and in the early 2030s we expect adoption to reach the tipping point (10-20% market share). Following this, market adoption will be exponential through the 2030s, reaching high levels by 2040 (Exhibit 1).

What makes us so positive that alternative proteins are going to follow this trajectory? In this piece we will break down the S‑curve further to consider what positive – and perhaps less positive – signals we will be tracking to monitor the adoption of alternative proteins – and how the media assessments play into this.

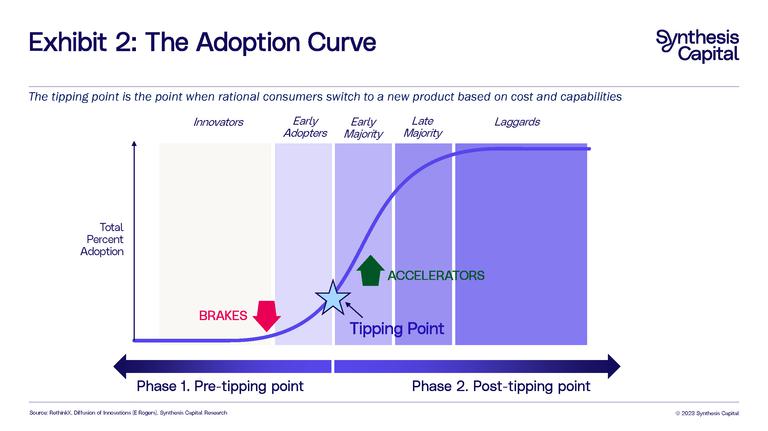

At Synthesis we think about the S-curve in two phases (Exhibit 2). Phase One is the period before the tipping point, and Phase Two is the period after the tipping point, when adoption hits the exponential growth – or mass market adoption – phase. The tipping point itself is defined as the point at which the rational consumer switches to a new product based on cost and capabilities.

One of the key points made in Everett Rodgers’s book “Diffusion of Innovation”[viii] is that consumers don’t all adopt an innovation at the same time, and as such there are different categories of adopters. These categories (innovators, early adopters, early majority, late majority and laggards) are loosely shown in Exhibit 2. This piece will focus mainly on supply and regulatory milestones for adoption, but we will explore consumer adoption in more detail in a future piece of work.

One point to mention here is our definition of alternative proteins. For us, this means all types of alternative protein production – and crucially – not just plant-based protein. Our definition includes single-cell proteins like Quorn, as well as precision-fermented derived proteins like Perfect Day's animal-free whey. It also includes products and technologies not available to the masses as of writing, such as cultivated meat and other proteins produced through recombinant methods like precision fermentation and molecular farming. ‘Plant-based’ and ‘alternative’ are often used synonymously when talking about the industry – and we understand why. The only alternative protein products that many consumers can currently access are plant-based ones. However we encourage everyone to think "beyond" plants!

Our definition of "alternative proteins" means all types of future protein production – and crucially – not just plant-based protein.

Phase One – Pre-Tipping Point

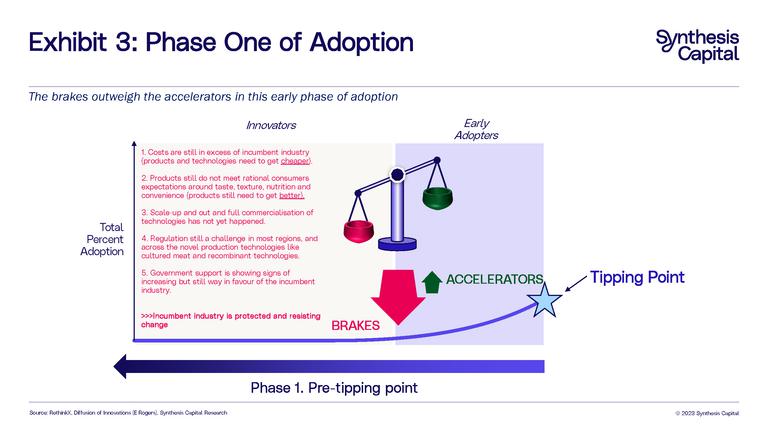

Currently we are early in Phase One for alternative proteins, with market share estimates of around 1%[ix]. Consumer adoption is being driven by social or environmental reasons rather than by cost and taste. Products are starting to enter the mainstream – but costs are still high relative to traditional products, and/or the quality (in this case, taste and texture) is not as good.

Phase One is the period when these products are still undergoing proof of concept and – most relevant for alternative proteins – scale. Can you make cow’s milk and meat outside an animal? Yes, a small number of innovative companies have shown you can! Can you scale up production – we believe so – but there is still work to be done.

As this is a technology driven transformation, cost and quality remains important for adoption. For truly disruptive adoption to take place, the alternative products need to at least match animal-based proteins on taste, price, convenience and nutrition. And they don’t yet – most meat-eating consumers would not switch to the alternatives available today. This is a fact that the media has rightly grasped.

The pre-tipping point phase can be long, because it is during this phase when all these issues are being ironed out, infrastructure is being built, and the regulatory landscape navigated. Can you scale it up? What are the feedstocks? Where will the energy come from? What should we label it? What is the nutritional profile? The technology risks are high and many, making it a less certain bet for companies and investors.

During this phase, the brakes far outweigh the accelerators. For alternative proteins, products are still not meeting rational consumers’ expectations around taste, texture, nutrition and convenience. Costs are still too high and products are not affordable. Some of these technologies are yet to reach the consumer; getting regulatory approval remains a core brake to adoption. The challenge of how to scale these technologies is still in the early stages of being solved. Full commercialisation has yet to happen. Government support is sparse. This means the incumbent industry is protected and resisting change (See Exhibit 3).

Key Milestones in Phase One

1. Technologies across the board are getting cheaper

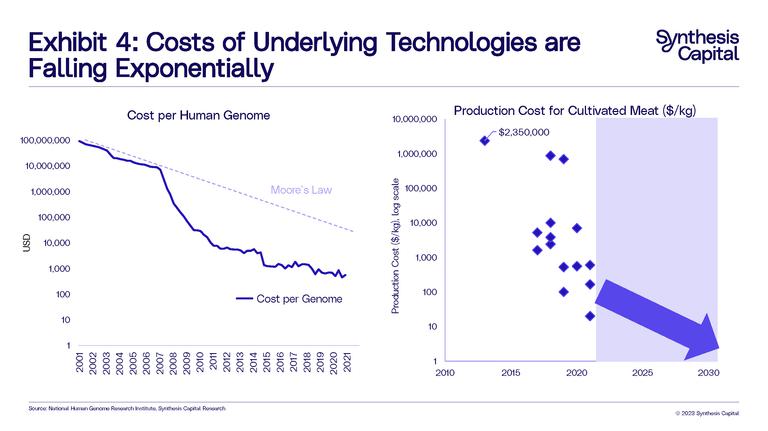

At Synthesis we have a unique top-down view of production costs in the industry and how they are developing. Costs are falling exponentially. This is not surprising, as the costs of underlying technologies are also falling – driven by improvements in synthetic biology. This is illustrated by the cost to sequence the human genome, which has been falling at a faster rate than Moore’s Law. Our proprietary database shows that costs for cultured meat production have fallen exponentially over the last few years (Exhibit 4). There are similar patterns for production using precision fermentation technologies.

2. Alternative protein products are getting “better” across a range of metrics

Not only do these products need to be cheaper, but also better – as consumers are still unwilling to pay a price premium for alternative meat. There is no doubt that plant-based meat alternatives have made leaps and bounds over the last 15 years in terms of taste and texture; we have come a long way from the veggie burgers of the 90s. Today, brands like Impossible Foods and Redefine Meat have married food and technology to create burgers that bleed and 3D printed steaks with muscle fibres held together by “connective tissue.” It is harder than any point in history to tell the difference between some of the best alternative proteins and the real thing. But, you can still tell the difference. The good news is that even products already on the market are continuing to evolve and improve.[x]

To disrupt the incumbent industry, alternative proteins need to be better than traditional meat and dairy. However being better is not just about taste and texture, but will also depend on the more value‑based metrics, such as nutrition, environmental and social impacts, land and energy use, and animal welfare. Proving this is a moving target, as products and technologies will continue to change and improve. This is something the new alternative protein industry will need to demonstrate again and again with evidence.

For example, in terms of nutrition, data demonstrates some advantages (e.g. no cholesterol, higher fibre) and some disadvantages (higher sodium, more additives) for alternative protein products from a health perspective. As industry leaders, we want alternative proteins to be produced more responsibly with lower environmental and social impacts than conventional animal products. It is also important to expand this responsibility to the end products themselves in terms of consumer experience across taste, texture, and nutrition.

It is harder than any point in history to tell the difference between some of the best alternative proteins and the real thing. But, you can still tell the difference.

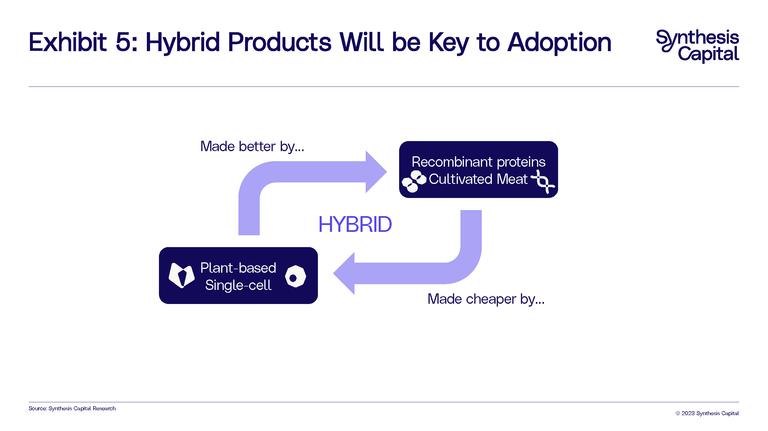

Hybrid products are necessary to allow emerging technologies to get cheaper and better

There are clever ways to make the end-product cheaper for consumers. Hybrid or blended products (where you see a mixture of alternative protein sources such as cultivated meat + plant-based, precision fermentation + plant-based etc) have the benefit of bringing down costs and improving the quality in terms of taste experience (Exhibit 5). The 2019 RethinkX report referred to this as an “ingredients-led business-to-business disruption”. In our insights piece “Six Predictions for the Alternative Protein Sector in 2023” we discussed how blended products would be a key go-to-market strategy for many companies.

Which milestones to watch for around cost and quality:

- Quality of products on market continue to improve, not just in terms of taste and texture but also nutrition and other more intangible values related to consumer experience.

- Breakthroughs in terms of blind taste testing of alternative proteins and conventional animal-based products.

- Alternative proteins become cost competitive with conventional products.

- Consumer purchasing data show repeat purchases from people who identify as flexitarians and not vegans/vegetarians.

3. Focus turns to scale-up to increase supply

Alternative proteins have seen a slow down in sales in some regions and settings, as products are not hitting the mark in terms of cost and quality. However, as products are improved by advancements in technology (3D printing, precision fermentation and cultivated meat for example), we are likely to see demand explode, and in our view, the industry is more likely to face a supply problem than a demand one. We see that already with some of the best alternative meats and dairy products on the market, and any company able to produce animal-free proteins, meat, or cheese that is of good enough quality and at a competitive price will have little difficulty finding a market. Of course, we are not yet there – and part of the equation is the need for the industry to increase production.

The scale up process is not simple, but it is firmly in the sights of many companies (there are dozens of companies currently working on scale-up associated problems such as bioreactor design and bioprocess optimisation). However, this process will not be trivial, as a whole infrastructure needs to be built, not forgetting supply-chains and supporting industries. This is not insurmountable, but it will take time. Wright’s Law says that costs depend on experience (in this case measured by cumulative production over time), so costs will also fall as we see capacity expand.

All this will require significant investment. The next few years will see investment diversify from being dominated by venture and equity capital, to more infrastructure investing and project financing as we see the technology being de-risked. Existing companies from all parts of the food supply chain (for example, Novozymes, Nestle and Tyson, amongst others) have reasons to invest, and, indeed, have begun to do so.

While in the venture space we talk about building this new industry, the flip side is that this change is triggering resistance in the incumbent animal agriculture system, which is protected by sunk costs in infrastructure. Indeed, the investment in the incumbent system is continuing.

In 2021, U.S Livestock Farms invested almost $30 billion in capex related farm expenses, from farm improvements and construction to repairs to new machinery and equipment, and over the last 10 years this means over $250 billion has been invested into US Livestock farms[xi]. This on‑going investment continues to protect the traditional livestock farming industry.

Which milestones to watch for around scale up

- We see significant growth in capacity every year. This could be measured in a variety of ways such as number of facilities, litres of capacity or tonnes of production.

- The number of products on the market with new technologies also grows significantly. The growth in number of products should exceed the percentage capacity growth as many of the products are ingredients and incorporated in low percentages.

- Technological advances lead to higher efficiencies around scaling up precision fermentation and cultivated meat production. These could be around bioreactor design, strain engineering or optimised bioprocesses.

- Incumbent companies invest in capacity and technologies.

- New types of non-equity finance (for example debt or green bonds) being used as risk-adjusted returns improve and the industry grows.

4. Regulation remains a challenge but key breakthroughs are achieved

Legislation and policy also continue to be in favour of the incumbent industry. Regulatory approval for the new technologies is slow and you can count the regulatory approvals in the alternative protein sector on one hand. In the U.S., Perfect Day and EVERY have received “No Questions” letters from the FDA for their animal-free whey and egg protein, and these products are on the market. UPSIDE Foods also recently received a “No Questions” letter from the FDA for their cultivated chicken product, and we are now waiting for the USDA’s green-light for the product before it can go to market. Meanwhile, Singapore has approved GOOD Meat’s chicken, which is on the market at a small scale there.

Lobbying heightens the barriers to adoption: as well as the slow regulatory approval of cultivated meat, there are several labelling challenges on whether these products can use “meat” or “milk” to describe their plant-based alternatives. The good news is we have seen this playbook before throughout history – many times – from the disruption of the horse by the car, to the disruption of open water ice by “artificial” ice. This is merely part of the pattern of disruption as the incumbent industry fights the change.

While it is frustrating that the hurdles are slow for regulatory approval, these brakes can quickly switch to be accelerators. Over the next year we expect more US approvals for cultivated meat, with other countries likely looking to the country for guidance. It is feasible that by the end of 2023 we could see cultivated meat on the market in 2-3 countries as opposed to the current one. Europe remains a difficult market given increased regulatory challenges.

Importantly, we are also observing some promising signs in terms of policy support, with several governments around the world mobilizing around this technology, either by stepping up their commitment to alternative protein or the bioeconomy more broadly, or by issuing guidance for the regulatory approval of the products coming from these new technologies. In January 2022, China’s five-year agricultural plan was released with cultivated meat and other alternative proteins included in its blueprint for food security.[xii] Meanwhile, the US unveiled its strategy to grow the national bioeconomy 2022, with further reports around biomanufacturing, and alternative proteins falling firmly in the remit.[xiii] Other countries including the Netherlands, Norway, France and Germany have also invested in or announced funds that can invest in food technology.

Which milestones to watch for around policy and regulation:

- Cultivated meat being available to consumers in a major economy like the US.

- Further GRAS notifications for the production of animal-free proteins, and FDA “no questions” letters for cultured meat and recombinant proteins.

- These should lead to momentum around a faster regulatory path to market for alternative proteins in other major jurisdictions, potentially culminating in a race to market between some countries.

- Further governmental buy-in through policy. For example in the mid-term we may see procurement targets for public institutions around protein. For example, this could be that 50% of consumed protein comes from more sustainable sources. It is also feasible that in the next 10 years we see meat taxes introduced in a number of regions.

- The introduction of commitments around reducing intensive livestock farming may increase over the next few years, for example by integrating livestock reduction into COP commitments on methane targets. The Global Methane Pledge[xiv] launched in November 2021 has participants who together are responsible for 30% of global human-caused methane emissions. By joining the pledge, companies are aiming to work together to collectively reduce methane emissions by at least 30% below 2020 levels by 2030. In 2019, agriculture (most of which is livestock) accounted for 40% of global methane emissions.[xv]

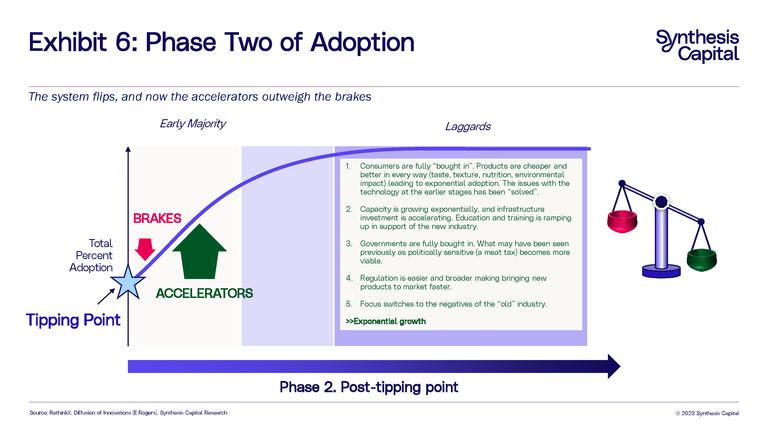

Phase Two – Post-Tipping Point

Crucially, this second phase comes after the adoption tipping point is reached. The tipping point itself is defined as the point at which the rational consumer switches to a new product based on cost and capabilities, and adoption market share has reached between 10-20%. This means alternative proteins are both at least as cheap as or cheaper than, and at least as good as, conventionally produced products. Essentially this means the product will be indistinguishable to animal sourced meat and milk from the point of view of a “rational” consumer. We believe this point will be reached in the mid-2020s. The products available to us will be markedly different to the ones we buy today, and as a result consumers will be making their choices based on a very different type of product.

A crucial part of phase two is that what were once brakes switch to accelerators. Many products have now been approved by regulators and that process is much easier for companies. Governments are fully bought in and there is better and clearer information about the benefits of alternative proteins. Production has scaled up, which de-risks investment, leading to more investment and buy-in, and triggering further cost and capability improvements (Exhibit 6). This is when the industry sees exponential growth.

Death spiral for traditional industries

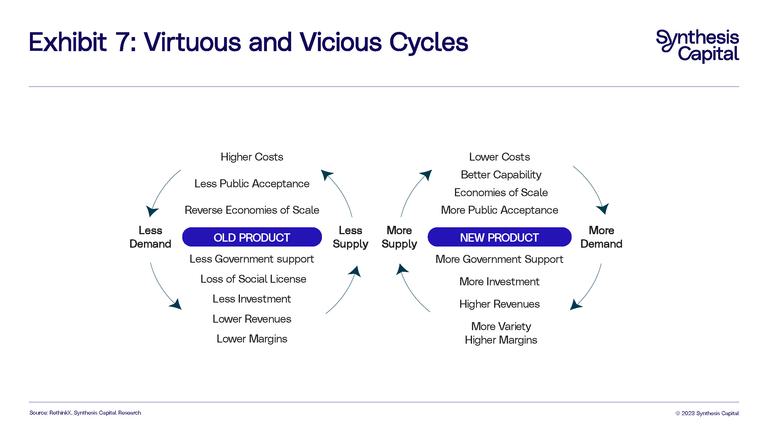

The growth in one industry impacts the old industry. Traditional farming may see consumer, industry, and government support wane, leading to lower revenues and investment. This can lead to a “death spiral” (Exhibit 7).

An example of this has been the variety of supportive government policies around the world for electric vehicles (EVs) or zero‑emission vehicles (ZEVs). These policies have helped drive adoption of EVs by lowering the cost of ownership through subsidies and rebates, and are driven by broad policy such as in the UK where sales of new ICE (internal combustion engine) cars will be banned from 2030. The UK is not the only country to take this stance - the EU, China, Japan and Israel are all introducing similar policies.[xvi] This has led to many car manufacturers having to switch focus and investment to electric vehicles to avoid simply being out of business in many of their key markets.

De-risking the technology will also continue to drive investment into alternative proteins. Revenue will grow, costs will fall and products will get better. On the other side of this will be falling revenues and higher costs in conventional farming industries.

Today, a policy like a “meat tax” seems politically unlikely, but once these technologies start to ramp up and their potential is more fully realised and understood, we may see this sentiment change, and a meat or animal product tax may be more plausible and accepted.

For alternative proteins, we expect the exponential adoption phase will be reached through the 2030s.

Conclusion

Looking back at these disruptive innovations from the internet to the car which went on to be so successful, improvement didn’t end at the point of mass adoption. Indeed, these innovations go on to converge with other disruptive technologies, and continue to improve significantly over time.

The smartphone is a great example of this; the smartphone plus the internet went on to enable on‑demand everything (taxis, music, food). In fact, if it hadn’t been for the smartphone, would the internet be so fast today? When the internet gained critical mass in the late 90s and early 2000s, few would have imagined the scale of the businesses the internet would power (cloud computing, digital advertising, e‑marketplaces).

As we think about what the food industry of the future will look like, we need to take these lessons into account. The move to alternative proteins and importantly to a whole new production system will create entirely new value chains, many of which are difficult to predict or even imagine today. And each part of that new value chain will have successful businesses across them – for example computational software to optimise processes, novel bioreactor designs, strain discovery platforms, and many other business models we can't even think of today.

So while we remain vigilant about the current challenges faced by the alternative protein industry, let’s also keep at the top of mind its potential for real and significant change – and the investment opportunities that come with that potential.

[i] Bloomberg Businessweek. “Fake Meat was Supposed to Save the World. It Became Just Another Fad.” The article can be found here. Impossible Foods posted a rebuttal article “Bloomberg was Supposed to Report the Facts. It Became Just Another Opinion Piece.” here.

[ii] In 1903 the attorney Horace Rackham, who was considering an investment into Henry Ford’s automobile company, visited an unnamed banker to get advice. It was this banker who advised him not to invest. “The horse is here to stay, but the automobile is only a novelty – a fad”. The original quote can be found in Sarah. T Bushnell’s 1922 biography of Henry Ford, titled “The Truth About Henry Ford".

[iii] The internet was declared as over by many media outlets. In February 1995 Newsweek published an article by Clifford Stoll predicting it was a fad entitled “Why the Web Won't Be Nirvana”, which is fortunately preserved on the internet here. The Daily Mail declared “Internet ‘may be just a passing fad as millions give up on it’” in December 2000. A link to the article can be found on this thread. Even Bill Gates is also famously attributed with thinking the internet was a passing fad. In his 1995 book The Road Ahead he wrote “Today's Internet is not the information highway I imagine, although you can think of it as the beginning of the highway."

[iv] In 1922 The Literary Digest asked “Is Radio Only a Passing Fad?”. The article can be seen here. The sentiment was even repeated in the fictional Downton Abbey, “It’s a fad, it won’t last” found here.

[v] In 1972 The New York Times declared “Is Women’s Lib a Passing Fad?”. Article can be found here.

[vi] June 2007, TechCrunch, The Futurist: We Predict the iPhone Will Bomb. Found here. The iPhone had its fair share of non-believers. This Forbes article covers it well.

[viii] Rogers, E. M. (2003) Diffusion of Innovations, 5th edition. Free Press, New York

[ix] GFI publish an annual report on the plant-based food market in collaboration with the Plant-Based Foods Association and SPINS. The most recent report can be found here.

[x] Impossible are reformulating to have less fat than beef. Please find article here.

[xi] Farm Production Expenditures 2021 Summary (July 2022) 9 USDA, National Agricultural Statistics Service.

[xii] Time. China’s New 5-Year Plan is a Blueprint for the Future of Meat. January 2022. Found here.

[xiii] Report to the President. Biomanufacturing to Advance the Bioeconomy. December 2022. Found here.

[xiv] The Global Methane Pledge. Link here.

[xv] Our World in Data shows the breakdown of methane emissions by sector here, and data around the impacts of food on the carbon footprint of foods is explained here.

[xvi] This report from the IEA gives a good overview of various global policies around EVs and ZEVs.