S-Curve Adoption: Our House View on Alternative Protein Market Growth

• Market Update • Opinion

Adoption via “S-curves” is nothing new

History is littered with examples of technological products and services that were adopted with the famous “S‑curve”. This adoption shape is ubiquitous, with products as diverse as refrigerators, cars, color TVs and smartphones all showing that same familiar S-shaped curve.[i] This concept of adoption was popularized by Everett Rogers in his 1962 book “Diffusion of Innovations”[ii], where he analyses how innovations disseminate through a population. Since then, numerous books and academic papers have built on this theory and applied to a range of sectors.[iii] In particular, the S-curve can be applied to technology adoption, where it has been shown to exist across a range of products and across multiple decades (Exhibit 1). All these are the result of technological convergence which acts as the catalyst to enable products, businesses, and services with certain functionalities at a certain cost not available before.

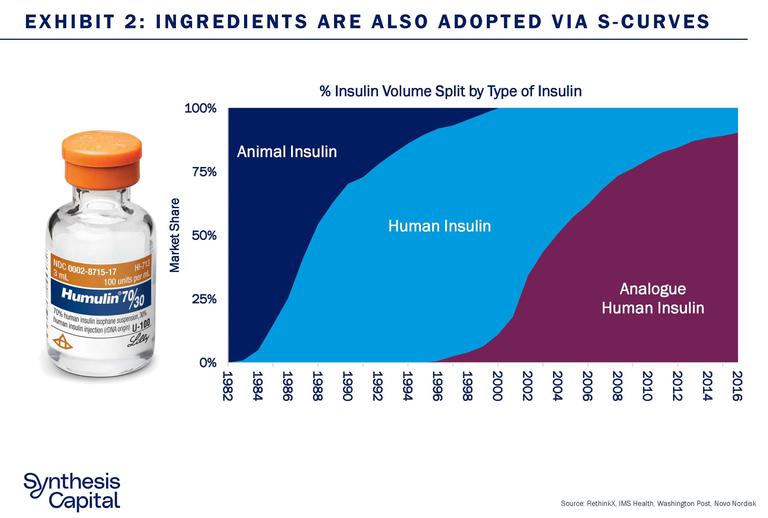

But S-curve adoption is not just limited to information technologies. A range of ingredients and pharmaceuticals have also demonstrated the same adoption profile. Products as diverse as citric acid, rennet and insulin have all been adopted through S-curves.[iv],[v] Indeed insulin has seen two concurrent adoption S-curves, as animal insulin was first disrupted by human insulin and then human insulin disrupted by human analogue insulins (Exhibit 2).

Even when we see industries midway through an S-curve adoption, industry experts can shy away from incorporating them in their models. This reluctance is likely because predicting when adoption moves out of the linear phase and into the exponential phase is challenging. This is especially true when, as for alternative proteins, we are in the earliest stages of adoption, and the path forward is unclear. As an analyst it can simply be more comfortable to forecast linear adoption. But this can often overestimate growth in the short term and underestimate growth in the long-term.

Alternative proteins will be adopted via S-curves

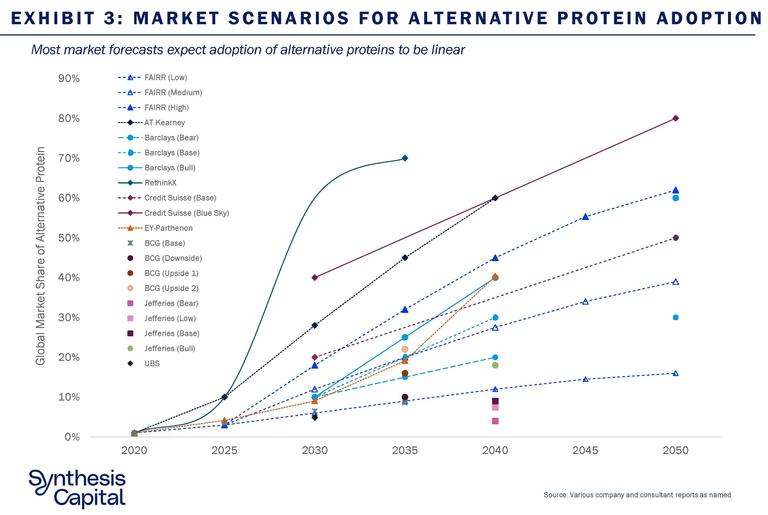

We see a strong tendency towards linear projections in the alternative protein adoption forecasts in the market, barring RethinkX’s 2019 analysis which models S-curve adoption. Indeed, for the most part, the forecasts remain linear even when total projected market adoption is over 10% (Exhibit 3).

In contrast to these linear projections, we firmly believe alternative proteins will be adopted in an S-curve fashion. What does this mean in reality?

Reaching the tipping point can take a long time

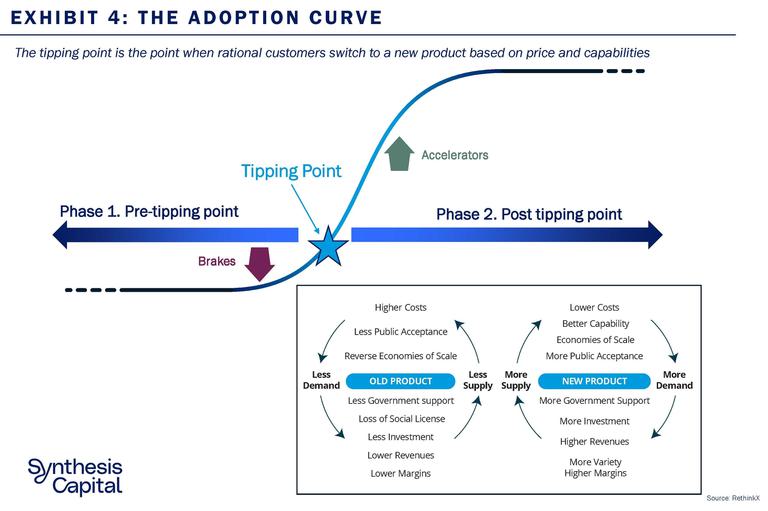

We think about the S-curve in two phases (Exhibit 4). Phase One is the period before the tipping point, and Phase Two is the period after the tipping point, when adoption hits the exponential growth phase. The tipping point itself is defined as the point at which the rational consumer switches to a new product based on cost and capabilities.

Phase One is a vital and complex period. For potentially disruptive products this is where proof of concept happens, products are tested and trialed, capacity and infrastructure is laid, and products enter the market. Simultaneously, cost curves fall and the capability of products are improved. This phase is usually already built on decades of technological advancement, and can take years (there is a reason in Exhibit 1 above that many of the exponential curves start at around 10% market adoption).

During Phase One, which is where we are today for alternative proteins, early adopters are driven by social or environmental reasons rather than cost and taste. However, these products are yet to fully enter the mainstream; the costs are still high relative to traditional methods, or the quality, (in this case, taste and texture), is not as good. Absolute sales numbers and the market share percentages are still very low (market share estimates for alternative proteins are only around 1%).[vi] While the market shows strong potential, this phase can be marked by volatile growth, which is expected so early on in a product’s lifecycle: absolute numbers are small and therefore growth can be disproportionately large or small. In addition, alternative products are still more expensive and cannot compete on taste and functionality with conventional products. We are seeing this today for plant-based meat in the US which is seeing a significant slowdown in growth in 2021 versus 2020 (and the preliminary numbers indicate further slowdown in 2022). [vii]

Reaching cost parity will be key, and our expectations on costs are aligned with RethinkX: we think cost parity will be reached with bulk animal proteins in the mid-2020s. In addition, new technology is needed to enhance quality. Precision fermentation and cultivated meat production are advantaged because they are producing proteins and products bio-identical to those found in animals. These new technologies are vital either on their own, or to enhance existing plant-based products to ensure the quality (in terms of taste and texture), continues to improve.

However, it still takes time to get adoption to the tipping point, as supply, demand and regulation will continue to act as powerful “brakes”, hindering adoption of these products and services, and protecting the incumbent system. The traditional animal agriculture system is protected by sunk costs in infrastructure, benefits from large economies of scale and is supported by legislation and policy. Value chains are mature, and public opinion remains, for the most part, supportive, as customers are accustomed and attached to their roast dinner or BBQ steak. We still have work to do to get to the tipping point for alternative proteins. Products still need to be cheaper, more convenient and taste better.

We are at the point in the development of the alternative proteins industry where change is triggering resistance in the incumbent system. Lobbying continues to mean there are barriers in place for adoption: for example, the slow regulatory approval of cell-based meat, or the inability to use “meat” or “milk” in the name of plant-based alternatives. The good news is we have seen this playbook before throughout history – many times – from the disruption of the horse by the car, to the disruption of open water ice by “artificial” ice.[viii]

This resistance will be overcome. Regulation and consumer preferences are not static. But change can take time, and is likely to take longer than expected. This is why we expect that, despite many of these alternative proteins likely reaching cost and taste parity with current traditional protein in the mid 2020s, adoption will not reach the 10-20% required for the tipping point (when adoption enters the exponential phase) until the early 2030s.

But then adoption will be faster than expected

Phase Two is post the tipping point, and adoption becomes exponential. While the tipping point can vary by industry and technology, if we assume the new product is both cheap and good enough, generally the tipping point for adoption is when the market share for the new product reaches between 10-20%.

At this point, growth accelerates, as not only is one industry growing, but another is imploding as it struggles to capture investment, sees revenues and profits fall, and generally undergoes a “death spiral” (Exhibit 4). Those factors that once acted as “brakes” to adoption of the new systems, become “accelerators” to the disruption process. Lower costs and better products drive demand, investment in capacity and infrastructure drive supply and regulation can move in favour of the new system. Imagine in 10 years the introduction of a “meat” tax. Just like we have for sugar in the UK, and many countries around the world, from Mexico to South Africa. These will all act as powerful accelerators to the alternative protein industry, and also act as brakes to the incumbent industry. Traditional animal-based products will face a death spiral of increasing costs, lower demand, a loss of investment, and the companies will consequently face bankruptcy. For alternative proteins, we expect the exponential adoption phase will be reached through the 2030s.

We estimate that alternative protein growth will become exponential through the 2030s

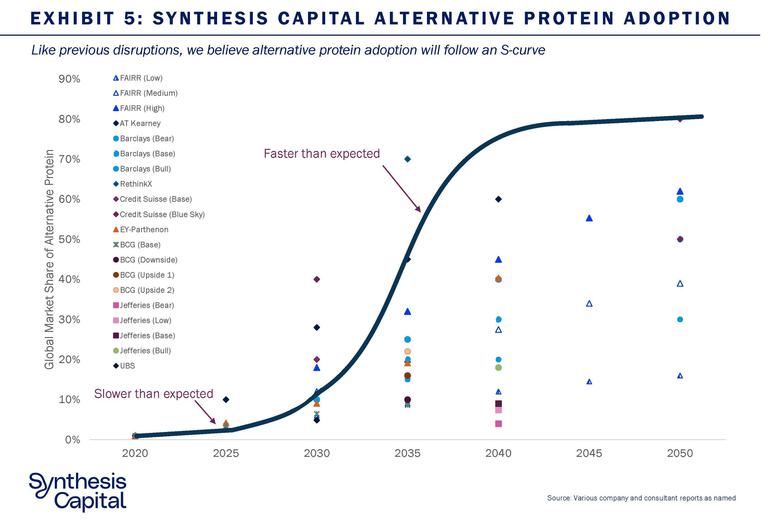

From our work we estimate that over the next five years, adoption could be slower than expected. From 2027 onwards, we expect there to be enough trigger points coming into play for adoption to start accelerating, and in the early 2030s expect adoption to reach the tipping point (10-20% market share). Following this, market adoption will be exponential through the 2030s, reaching high levels by 2040 (Exhibit 5).

It should be noted that growth generally stagnates after reaching a certain market adoption level. This is because animal agriculture will still exist, but there will be far less of it. There will be laggards and non-adopters, as we see for other technological disruptions. Examples could include some regions where animals provide more value than just food (such as labour and food storage), or regions where animal agriculture is part of a more holistic regenerative system.

This adoption pathway is not set in stone. Investment is required, brakes and accelerators continue to fluctuate, and regulation and consumer preferences remain dynamic. But our analysis reinforces our conviction in the significant opportunity in investing in alternative proteins and the transformation of the food system. The speed of technological development in the sector demonstrates that we are well on the way towards a tipping point, and that exponential growth will follow.

We are well on the path towards a tipping point and the exponential growth that will follow

Sources:

[i] Many of these famous technology charts originate from this original visualization. This version is from Blackrock.

[ii] Rogers, E. M. (2003) Diffusion of Innovations, 5th edition. Free Press, New York

[iii] For example: Moore, G. A. (1991). Crossing the Chasm: Marketing and Selling High-Tech Goods to Mainstream Customers. New York: Harper Business.

[iv] Tubb, C. Seba, T. (2019). Rethinking Food and Agriculture 2020-2030: The Second Domestication of Plants and Animals, the Disruption of the Cow, and the Collapse of Industrial Livestock Farming. US: RethinkX. A direct link to the report can be found here.

[v] For more on the disruption of citric acid see here.

[vi] In the US plant based meat YoY retail growth in 2021 was flat, after growing 46% YoY in 2020. This data came from the Good Food Institute and the Plant Based Foods Association from SPINS. Please see here. Signs are that 2022 growth has fallen even further, with Beyond Meat laying off 4% of their workforce. Please see here.

[vii] Bashi, Z., McCullough, R., Ong, L., & Ramirez, M. (2019). Alternative proteins: The race for market share is on. In McKinsey & Company – Agriculture Practice. Find here.

[viii] For more on system disruptions please see Rethinking Humanity by James Arbib and Tony Seba. This can be found here. Systems dynamics and feedback loops are explained particularly in Framework Box 2 on page 22.