Cultivated Meat Science is Complex

• Market Update • Technology • Opinion

If you've been reading food industry news recently, you'll likely have the impression that the cultivated meat industry is destined for failure. Companies are not scaling quickly enough, and costs will never come down sufficiently for products to compete with conventional, animal-based meat – the science, they say, is just too complex to scale. However, as with most things in life, there’s more to the story.

From bitcoins and EVs, to pet mammoths and cultivated meat

In 2015, the mammoth genome sequence was completed, and the internet was flooded with articles stating that cloning attempts could begin by 2018. Many popular media outlets predicted that it would be possible to visit a baby mammoth in the London Zoo within the decade. Well, that didn't happen.

Likewise, the early predictions for bitcoins included visions of a global, fully democratized economy, freeing us all from the shackles of banks and other middlemen. Not to mention how, just a few years ago, we expected electric vehicles (EVs) to become fully automated any day, and for the entire truck fleet to be automated as well, leaving thousands upon thousands without a job. In fact, we now have a global shortage of professional truck drivers – and it’s getting worse.

How does this relate to investments in cultivated meat?

As with mammoth cloning and EVs, there were certainly a ton of bold, highly optimistic claims made in the early days of cultivated meat. Many of the same news outlets now proclaiming the demise of cultivated meat were, just a few years ago, telling us that cultivated steaks in our grocery stores were just around the corner while providing optimistic quotes from passionate founders, investors, and other industry stakeholders.

This type of hype is not unique to cultivated meat or food production—tech excitement and bad predictions are nothing new. However, there are two sides to the coin.

When Tesla first joined the market, no one believed they would be a serious car manufacturer, let alone that the brand would spark a global wave and a series of innovations in the EV sector. Today, we look back at the development of the car industry with a feeling of inevitability: of course, we were going to transition to EVs sooner or later. At the same time, we're cursing ourselves for not buying EV stock a decade ago. To paraphrase Danish philosopher Søren Kierkegaard: like life, technology can only be contextualized backward, but it must be invented forward. But can we get an idea of not just if a new technology would see mainstream adoption, but also what a more realistic time scale of that mainstream adoption would look like?

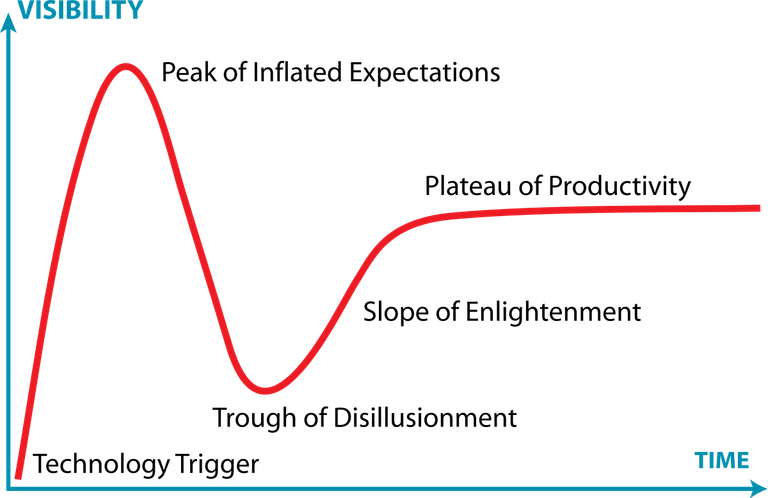

Enter, the Gartner Hype Cycle.

The Gartner Hype Cycle (seen above) shows us the journey of emerging technologies, from the initial buzz to their practical application. It showcases the typical journey of technologies from inception to widespread adoption, highlighting the phases of hype, disillusionment, enlightenment, and productivity. In other words, it shows us how trust in, and acceptance of, a new technology fluctuates over time, in a rather predictable pattern (if you go back to our post on technology disruption in food, you can see correlation with the S-curve).

Understanding the ups and downs of the hype cycle can help both companies and investors avoid focusing on a new technology too early, or giving up too soon (we’ve all heard the stories of people who bought bitcoins at peak hype, only to sell at the next “crash”). It can also help prevent focusing on an emerging technology too late, or hanging on to an idea that simply wasn’t happening, either because of a lack of interest, or because another technology overtook it. This was the case with mini-discs and Blu-ray, which were rendered irrelevant by streaming.

Why technology follows this pattern is rooted in psychology, but for now, we’ll focus on how we can locate our current place on the Gartner Hype Cycle.

Locating cultivated meat on the Hype Cycle - Unpacking the industry

Determining where the technological field of cultivated meat is, on the hype scale, is not unlike predicting the weather—we like to roll our eyes at it when it's incorrect, but most of the time, looking at data points gives us a pretty good prediction of what will happen. One way we can get a view of how rapidly the field of alternative proteins is advancing is by looking at two specific areas of the industry: patents and peer-reviewed publications.

The number of patents in a scientific field can offer some insights into the field's activity and the state of its related technologies. For instance, a high number of patents can indicate a field in a phase of rapid innovation. As well, for industries with potential commercial applications, companies are likely to file patents to protect inventions. While one can argue that not all patents are created equally, with some forecasting significant breakthroughs in the industry, and others accounting for minor improvements, they are all steps in the overall development of the industry.

There are now hundreds of published patents related to the CM industry, and the numbers are increasing yearly. A survey of the Google Patents database reveals patents describing a wide range of innovations to solve the challenges standing in the way cultivated meat getting onto the shelves of grocery stores. This includes:

• cell engineering to improve cell growth and density,

• cell culture media formulations to enhance growth and differentiation,

• novel bioreactor designs,

• processes to harvest cultivated meat,

• new scaffolding materials to create three-dimensional structured meat,

• systems to recycle cell culture media to reduce cost,

• methods to optimize the flavor and texture of cultivated meat products

• …And more

The number of patents is a useful indicator in determining the state of an emerging technology, especially when coupled with other data sources, for instance, the number of peer-reviewed articles published.

In contrast to the early years of cultivated meat research, there are now many academic labs worldwide performing research and publishing exciting data that demonstrate solutions to the above-mentioned challenges. A short search on The National Center for Biotechnology Information website for keywords like "3D meat structures" gets thousands of results, while "cell culture media for meat" is in the tens of thousands.

So, is this enough information to determine where CM is on the hype cycle, and, perhaps more importantly, if the industry is worth investing in? For some, yes. But there is a way we can dig deeper into the progress of cultivated meat research and shed light on the type of progress that is happening within cultivated meat companies.

Scalability of new industries - And relevance for the future of meat

As we know, consumer adoption is pivotal for new industries. It drives market demand, generates revenue, and reassures investors that they made the right choice by going with food science investments instead of half-baked mammoth resurrections, which, besides a sci-fi coolness factor, lack large-scale consumer appeal.

High adoption rates lead to economies of scale, fostering industry growth and attracting investment. Moreover, they trigger network effects and spur ecosystem development, establishing industry standards and complementary products—how about some cultivated bacon for your plantbased burger?

If you have doubts about the additional industries that food science will bring with it, think about this:

When the first automobile traveled its first bumpy mile, no one expected the dozens and dozens of related and adjacent industries it would spur. Everything from the concrete pavement, traffic lights, and motels to GPS and combustion engines boomed because of the rise of cars.

Even automotive safety glass, such as laminated and tempered glass, was developed to improve windshield durability and reduce the risk of shattering upon impact. This reinforced glass, a innovation "byproduct" of the car industry, is now used in large aquariums and terrariums to withstand water pressure, and in touchscreens and protective shields on laptops, tablets, and smartphones due to its scratch- and shatter-resistance.

All these innovations wouldn’t have been possible if not for the Ford Model T bringing the price of a car down to a level where mass-affordability was possible.

The challenges for consumer acceptance - Cost reduction, texture, and taste

As we can see, reducing cost was a key factor in the development of the car industry. The same applies to cultivated meat, and particularly here, the cost of cell culture media is a known challenge for the industry in reducing its cost of production. In particular, growth factors important for optimal cell growth and differentiation contribute a large proportion of the cost. When we look at the latest research, recent publications on this topic illustrate the progress happening within the industry, and shed light on similar breakthroughs that are happening within cultivated meat companies.

Earlier this year, for example, researcher Andrew Stout and his colleagues at Tufts University published a breakthrough made through genetically modifying cattle muscle cells. These engineered cells no longer require externally added FGF-2, a costly growth factor. This builds on their previous success in replacing another expensive ingredient (recombinant albumin) with a cheaper alternative (rapeseed protein isolates).

These types of advancements show a step-by-step approach to reducing cultivated meat production costs by finding substitutes or eliminating the need for expensive raw materials.

In addition to cost, the cultivated meat industry is also tackling taste and texture hurdles. Researcher Gaoxiang Zhu and colleagues at China Agricultural University described how they succeeded in growing porcine pluripotent stem cells (pluripotent stem cells are cells that can divide indefinitely and give rise to many different mature cell types) efficiently, while at the same time creating meat-like texture, by developing a system to mimic the way muscle cells grow in the body – muscle cells grow in 3D structures, which contributes to the texture of meat. Using low-cost, plant-based materials to create these 3D structures further reduces costs.

To add to the equation, the cultivated meat had enhanced textural properties, making the texture better than meat grown without the plant-based scaffold, and significantly closer to animal meat texture. The cultivated meat also had essential amino acid ratios, comparable to conventional animal meat, meaning that taste and nutrition were significantly closer to that of animal meat.

Zhu’s research combines advancements in three fields; animal cell biology, tissue engineering, and food science, showcasing the interdisciplinary nature and complexity of cultivated meat innovation.

The research described in these two papers is just a drop in the ocean compared to the hundreds of peer-reviewed articles fueling the cultivated meat industry. Together, they show the significant progress being made towards making cultivated meat a viable and attractive alternative to conventional meat.

Conclusion - Is mass adoption of cultivated meat around the corner?

No, we're not there yet, and with regards to investing in technology, there is, of course, no such thing as a sure bet. That being said, we are seeing a lot of promising progress in the industry, along with continued innovation, and more and more patents being filed every year.

In just the past few years, we've seen breakthroughs in affordability, regulations, and even small-scale market launches. While a Mc-Cultivated Quarter Pounder is not quite around the corner yet, there is ample evidence that the industry is making steady progress towards the tipping point that enables this.

In addition, we also see continued consumer interest in alternative proteins that are closer to the texture and taste of animal meat than current vegetarian and vegan options, meaning the market is more likely to embrace cultivated meat.

Developing efficient systems for growing animal cells takes time. In the world of medicine, it took over 50 years to go from isolating cells, to large-scale production. Cultivated meat is on a similar journey, but with exciting progress happening much faster, because it is building on the foundation of the breakthrough technologies in adjacent industries. This means that cultivated meat is making sure but steady progress to being on your plate.

If you want to follow industry progress and learn more about new food technologies, follow us on LinkedIn.

Footnotes: Within the past month, there have actually been a number of articles published claiming that science is, once again, one step closer to resurrecting the mammoth, this time setting the date of (re)birth in 2028. So, there's still time to ask Santa for a fluffy pet.