Plant-Based 101

What is Plant-Based?

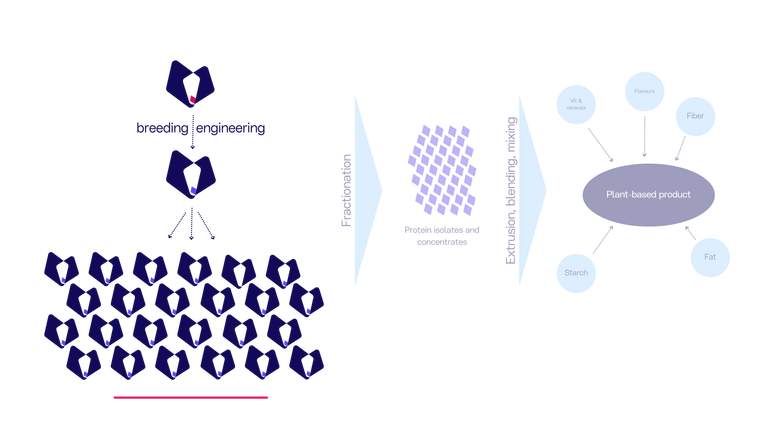

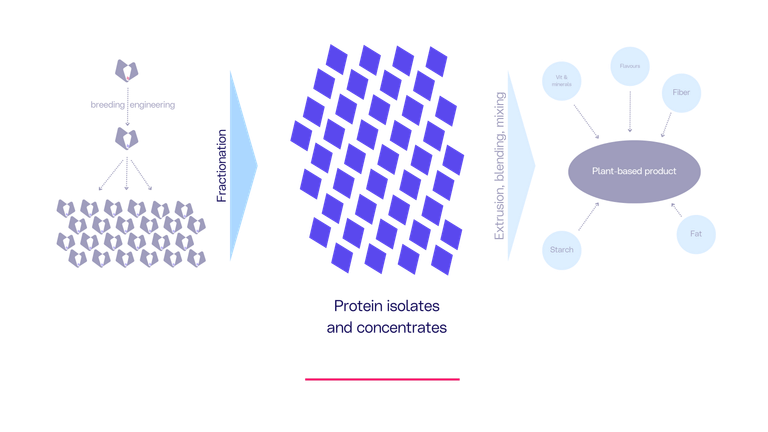

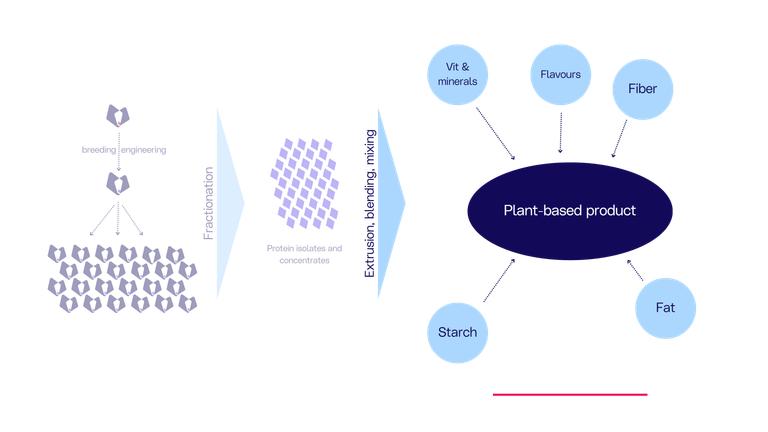

Plant-based alternative proteins are derived from crops. Plants are selected based on the product criteria and grown through traditional farming methods. These are then processed, and key ingredients are extracted from the crops (protein, starch, fiber & fat). The Proteins are combined to form high concentration isolates and concentrates. Plant-based products are then made by combining different ingredients with the protein concentrates & isolates until the desired taste and textures are achieved.

Overview

The plant-based vertical is the most mature of all the alternative protein technology verticals. While the first soy- and wheat-based meat alternatives were developed in the 1960s (think bland soy burgers!). In fact, we can trace the existence of some form of plant-based high‑protein product as far back as 900BC. Soy milk arrived in the west much later, production of soy milk products started in France in 1910 and subsequently arrived in New York in 1917. Plant‑based meat, egg and dairy alternatives have come a long way since then, and today we find them in many forms, available across multiple categories and regions.

The late 2000s saw a renewed interest in using plants to mimic meat in a way more palatable to meat eaters. Driven by environmental and animal welfare concerns Beyond Meat were one of the first companies to use this "biomimicry" approach, launching "chicken" strips in 2012. In 2011, Impossible Foods was founded with the mission of eliminating the need to make food from animals. To do this they focused on the burger, and brought together food science, biotechnology and consumer listening to help create a product that was "better than meat in every way", and launching their eponymous Impossible Burger in 2016.

The late 2010s saw a rapid growth in plant-based meat, egg and dairy analogues on the market. While Beyond and Impossible have been ahead of the curve in terms of using biotechnology, many companies have brough products relying on older technology like extrusion to add texture to plant based products.

Today, the majority of plant-based products on the market do not yet compete on taste and price with conventional animal-based meat, egg, and dairy products (currently plant-based meat alternatives are +67% [1] more expensive, on a global average).

Today, plant-based analogues need further innovation to better capture the flavour and texture profile of animal products. Technology innovation is required upstream of end-product formulation to create better crops, ingredients, and manufacturing processes. The key areas to be addressed are:

- Improve the taste, texture and overall sensory experience

- Narrow the cost gap

- Scale production and improving supply chains to meet future consumer demands

- Meet the nutritional expectations of consumers

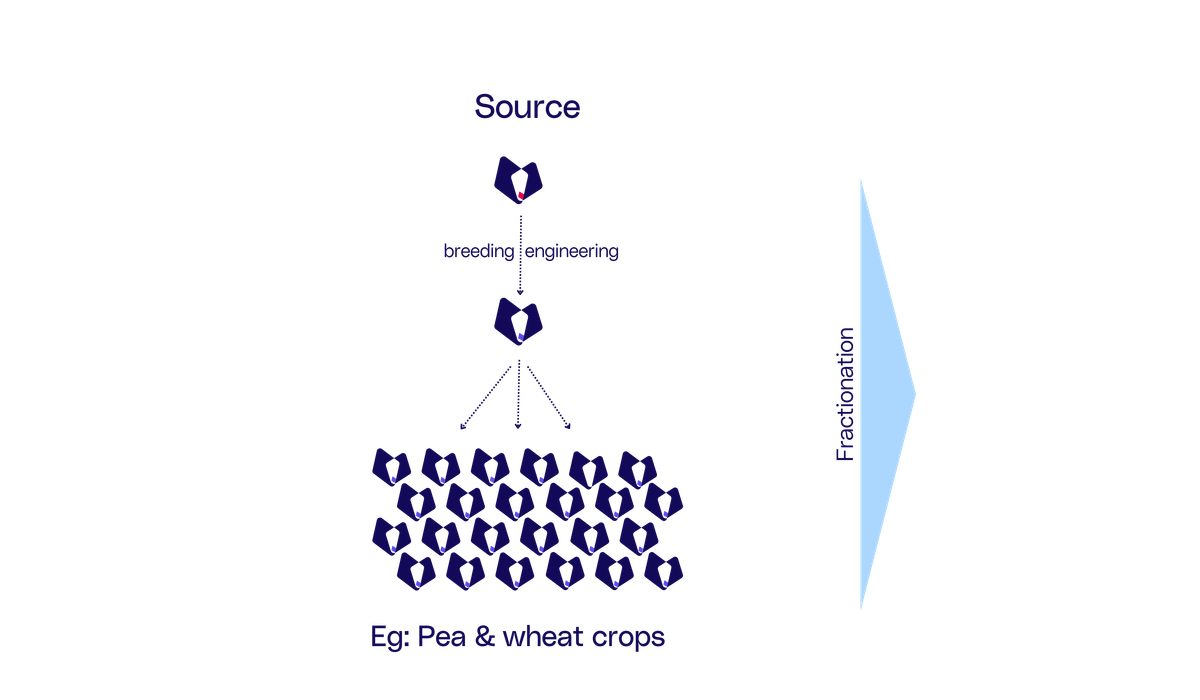

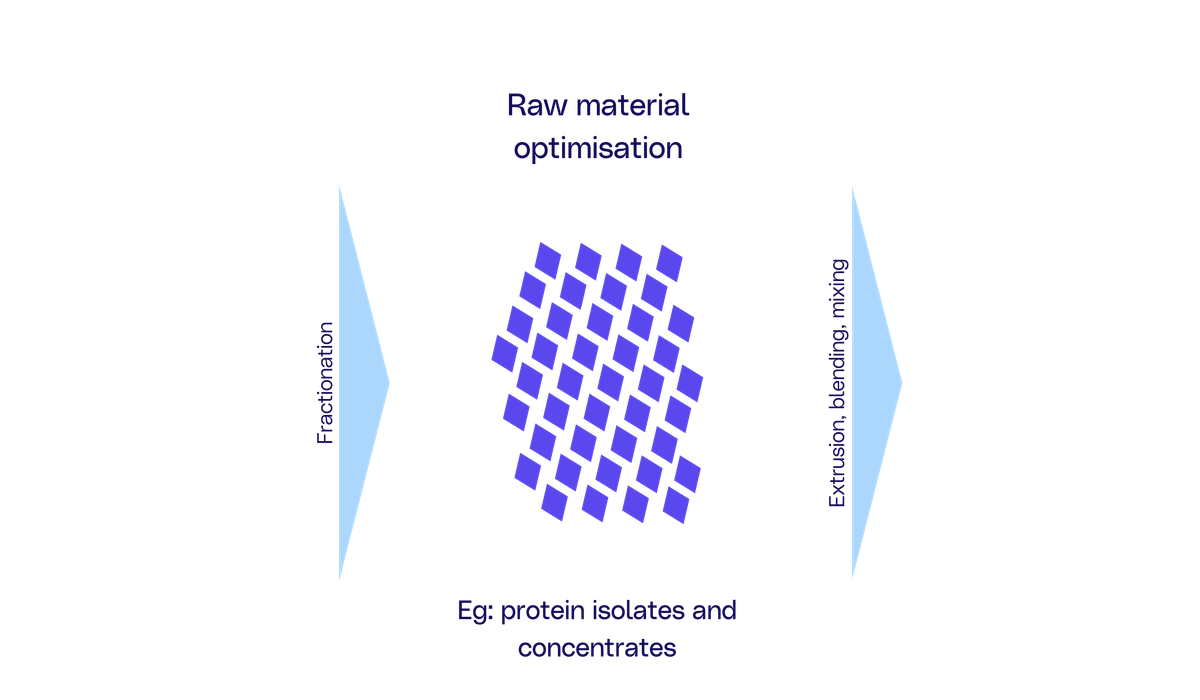

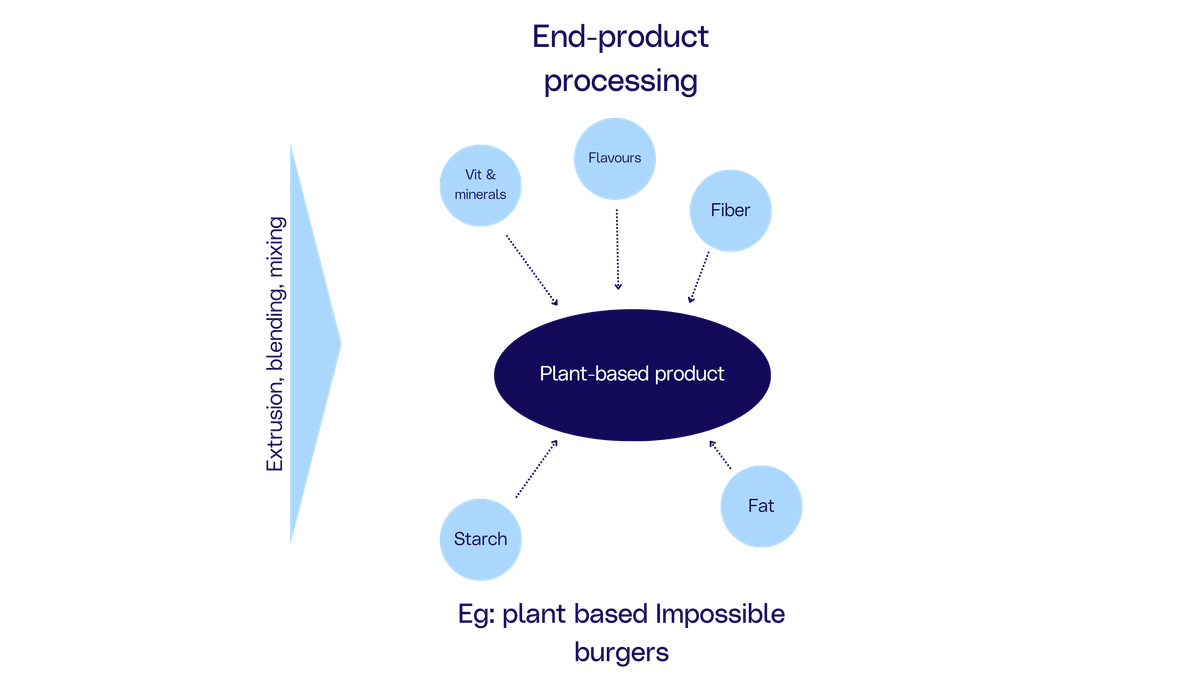

Addressing the barriers to adoption requires innovation throughout the value chain. The plant-based value chain is made up of three core components:

Source – Crops are the starting point for plant-based ingredients. Therefore it is important to breed or engineer the optimum crop based on the specific sensory, scale, cost, and nutritional requirements of the end-product.

Raw material optimization – Following harvest the crops are processed, and functional components (protein, fat and fiber) are isolated to create optimal ingredients for end-product utilization.

End-product composition and process optimization – Building up to the final desired product is achieved through specific ingredient blends and can also involve additional processing to help achieve distinct textures and structures.

Each of these steps can be further broken down into stages within which specific whitespace and areas of opportunity exist. Below we will explore these and discuss the challenges and opportunities of each.

Opportunities and Challenges Through the Value Chain

Source

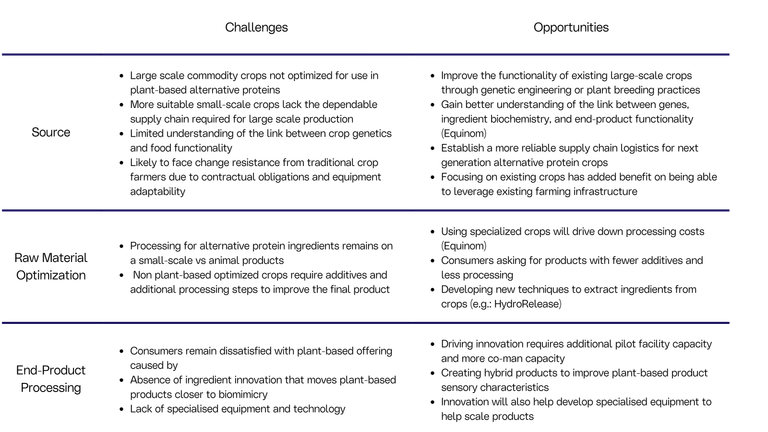

Source: Challenges

Most of some of the commodity crops grown in the EU are destined to be animal feed, e.g.: 88% of soy, 62% of cereal crops and 53% of protein rich pulses [2], and therefore there has been little incentive to optimize them to be used in alternative proteins products. They may have a low protein content, unappealing flavour profiles or be unable to mimic a ‘meat’-like texture when processed.

Other crops with smaller scale productions (e.g.: chickpeas, mung beans and lupins) may have better sensory properties which can closer replicate the nutrition, taste and textures of animal proteins but are less available on a large scale and lack a robust supply chain.

Although current technologies such as precision breeding and gene editing have significantly reduced the amount of time required to produce new crop varieties, the key lies in identifying which characteristic should be expressed, amplified, tuned down or removed - which gene will produce the “meatiest” taste or muscle-like texture while maintaining optimal yield and environmental robustness?

Even with the creation of new or improved crop varieties transitioning from conventional crops to novel plant-based crops may be difficult for livestock and conventional crop farms due to contractual obligations with seed and ingredient companies, soil conditions, and adaptability of existing equipment.

Source: Opportunities

Growing the selection pool of viable & scalable crops which are better adapted for use in plant-based meat, egg, and dairy applications can occur in different ways:

- Improvement of existing varieties through genetic engineering or selective breeding methods

- Identifying next generation crops that provide better inputs for plant-based meat, egg, and dairy alternatives and improving the supply chain of these crops

At Synthesis we think that both approaches present significant opportunities for investment, although currently the first opportunity is providing more investible opportunities.

Improving existing crop varieties requires developing links between food functionality, food biochemical properties and genetic coding; putting it plainly, we need to find which genes need to be edited to enhance or create a specific biochemical reaction and understand how that will impact the end-products’ sensory properties. Equinom, a Synthesis portfolio company, is taking on the challenge of mapping out these links via their proprietary data platform “Manna”. The data can then be used to direct targeted precision breeding for improved non-GMO variants of existing crops [find out more here].

AI and machine learning technologies could be a significant opportunity to radically speed up the search for the optimal genes. Modeling programs could predict product outcomes with a higher degree of accuracy and help identify genes and breeds that produce desired end‑product characteristics.

Importantly, crop circularity needs to be considered either when developing new strains or improving existing ones. This ensures all parts of the crop are used, simultaneously improving profits for farmers and being more environmentally sustainable overall.

Technology innovations could also be leveraged to improve small crop supply chain logistics with better supply and demand predictions, increased production and reduced costs.

Focusing on existing crops has the added benefit of being able to leverage existing farming infrastructure, however it is likely that existing contractual agreements with seed and ingredient companies could prove to be a hurdle. Despite this, we believe market demand for better products will ultimately drive this change.

By enhancing the crops themselves the benefits will go beyond just improved characteristics but also the functionality of the crop throughout the processing stages, reduction of wasted biomass and ultimately improve the bottom line.

Raw Material Optimisation

Raw Material Optimisation: Challenges

Following the harvest, crops go through an extensive processing phase to convert them into functional ingredients (e.g.: protein isolates and concentrates, oils, starches). This phase significantly contributes to the total cost of producing plant-based products driven by a number of factors:

- Alternative protein ingredient processing phase remains small-scale vs conventional animal products, which constrains supply chains and impacts costs

- Non-specialized crops require a number of costly additives and processing steps to be added in order to make the final products appealing in taste, colour, nutrition and texture

Raw Material Optimisation: Opportunities

Ultimately, reducing the amount of processing will help to drive down the overall production costs of plant-based products.

Developing specialized plant-based crops will reduce the number of additives and processing manipulations needed to transform the crops into purpose built functional ingredients. We see a significant opportunity with consumers who are looking for plant-based products with few ingredients and additives, reduced sodium and minimal amount of processing.

In addition, novel techniques for extracting ingredient isolates could also reduce the amount of processing required. To help achieve this, manufacturers should begin with the end-product desired characteristics and design the process around this. Currently the industry is disassembling raw materials from the crop only to put it back together during the end- product formulation.

End-Product Processing

End-Product Processing: Challenges

The final step is combining the different ingredients and applying various processes to help replicate the sensory experience consumers expect from animal products. Recent surveys [3] [4] [5] show that consumers are still not completely satisfied with the products on offer which still fall short of complete biomimicry, some key reasons include (in addition to upstream processing):

- The lack of ingredient innovation which is being exacerbated by the lack of specialized pilot facilities and co-manufacturers

- Leveraging technology from other industries which in addition to compromising on quality of products also limits scalability

Achieving a high quality product which meets or exceeds consumer expectations is essential for large scale product adoption and acceptance.

End-Product Processing: Opportunities

Driving innovation in all aspects is key to unlocking these bottlenecks. Developing new ingredients to enhance sensory experiences, such as the bounce of a salmon steak or the aroma of a soft cheese. Technology that is purpose built for replicating the sensory characteristics of animal-based products will be essential for the optimal use of these new ingredients. Redefine Meat’s 3D printing technology demonstrates that significant product improvements can be achieved with a detailed understanding of meat structure and flavour combined with machine innovation designed for animal product biomimicry.

Alone it is unlikely that plant-based products will be able to achieve true biomimicry of animal products, hybrid products however could significantly improve key sensory characteristics of these products (e.g.: plant-based ‘mince’ with cultivated beef fat).

A shortage in fit-for-purpose pilot facilities and co-manufacturers with alternative protein expertise also contributes to the slowing innovation process as businesses struggle to test and scale their products. Opportunities to overcome this are either to:

- Expand the number of facilities with the expertise to optimize and scale plant-based meat, egg, and dairy products

- Maximize the current facility’s capacity

- Build new sites through co-investment or partnership opportunities

- Ensure that new technology that is being designed for the industry is adaptable and compatible with multiple products and supply chains

Key to driving any change will be to improve the current products on offer to driver consumer adoption and demand.

Key Takeaways

Although the plant-based sector has faced criticism in the past few months, we believe that there is still plenty of scope for improvement and sufficient tailwinds of innovation to gain large scale adoption and consumer acceptance. As discussed, the 3 key areas of focus that will have the most impact are:

- Developing better source materials by improving existing or finding new/better crops

- Innovate technologies used to optimize the crops and streamline the process

- Develop a deep understanding of ingredients, tastes, textures and how best to combine these for the best sensory experience

Additionally, it is important to appreciate the link between all the food tech verticals (recombinant, single-cell and cultivated) as it is likely that the food of the future will leverage all of these technologies in one mouthful.

References:

[1] State of the Industry Report: Plant-based meat, seafood, eggs, and dairy. GFI (2023).

[2] Majority of European crops feeding animals and cars, not people - Greenpeace European Unit (2020)

[3] Alternative Proteins Consumer Survey (food.gov.uk)

[4] Sustainability | Free Full-Text | Consumer Acceptance of Alternative Proteins: A Systematic Review of Current Alternative Protein Sources and Interventions Adapted to Increase Their Acceptability (mdpi.com)

[5] A systematic review on consumer acceptance of alternative proteins: Pulses, algae, insects, plant-based meat alternatives, and cultured meat | Elsevier Enhanced Reader

by Rosie Wardle, Co-Founder and Partner