Feeding Our Future Food System: Can We Scale Glucose Production?

• Technology • Feature

The future bioeconomy will need to diversify feedstock

For those of us considering the future of alternative proteins on a daily basis, one of the biggest bottlenecks and challenges to consider as we expand capacity and production is the availability of feedstock to power these alternative protein production systems.

The future bioeconomy will be reliant on a number of processes such as fermentation and cell culture that rely on glucose feedstock as one of the key carbon sources. These processes will be a critical part of the bioeconomy, producing everything from alternative proteins to biomass to chemicals and therapeutic pharmaceuticals.

There is a reason glucose is so important and useful; it is the most abundant monosaccharide, the simplest form of carbohydrate, and a biological fuel. Glucose is a low-cost, and abundant feedstock, today derived from a variety of crops such as corn, wheat, potatoes and cassava, all with robust and entrenched supply chains.

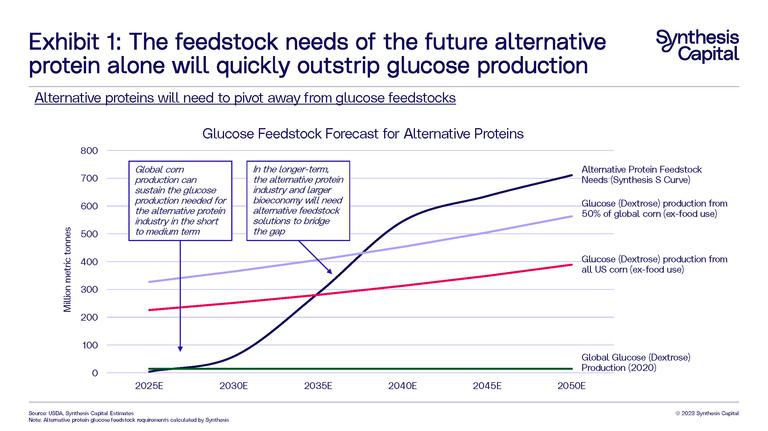

Today the global glucose and dextrose[i] production is 14.6 million metric tonnes (Mt) per year, with around 6Mt of that being produced in the US from corn.[ii] If we estimate the future global glucose needs just from alternative proteins (using the Synthesis S-curve), by 2035 alternative proteins alone would need over 250Mt per year, rising to over 600Mt through the 2040s.

To put this number into context, if all the corn produced globally (1,130Mt) was converted to glucose (not withstanding the wet milling capacity needed to do this!) it would yield around 675Mt of glucose. (If we excluded the corn used for food this would drop to about 585Mt). While glucose can be processed from crops other than corn, it is easy to see how the needs of the bioeconomy will rapidly outpace glucose supplies over the next 10-20 years (Exhibit 1) especially if we consider the needs of other parts of the biobased economy such as fuel, materials, pharmaceuticals, chemicals, and of course, human food. Both glucose and alternative feedstocks will be critical to the future alternative protein industry as well as the wider bioeconomy.

In this insights piece we consider two questions: What will be the alternative feedstocks of the future? Can we scale-up glucose production?

There are possible alternate feedstock sources

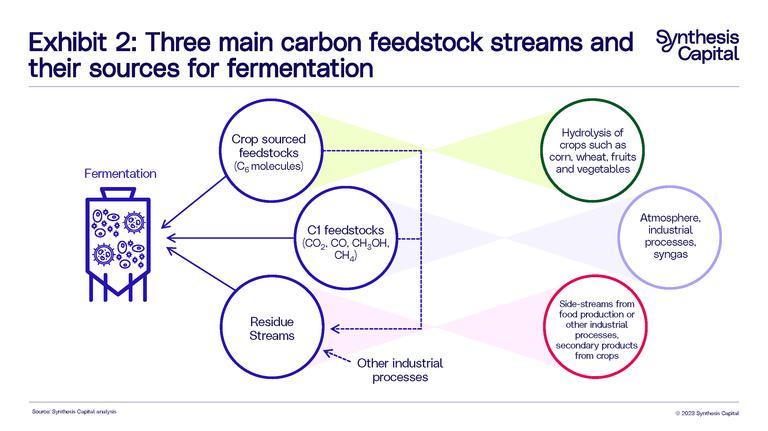

While crop-derived sugars are a simple and abundant source of carbon for the bioeconomy, they are not without their problems. Glucose production from crops is highly carbon and water intensive. There are other feedstocks with potential. An alternative source is “C1” feedstocks. These are compounds with just one carbon molecule in them, and examples include methane (CH4), carbon dioxide (CO2), carbon monoxide (CO) and methanol (CH3OH). Though abundant, these are extremely stable molecules and therefore require more energy for microbes to metabolise, presenting a more challenging problem. Nevertheless, they remain a key area of interest across a range of industries, as they can be obtained from the atmosphere, and other industrial processes.

Another potential interesting feedstock source is residue streams, which can be harnessed to produce sugar based or even C1 based feedstocks. For example, side-streams from food production could be used to capture glucose and other sugars, as well as secondary products from crops (e.g. molasses, potato pulp). The conversion of waste materials into gas (e.g. biogas) can be used to create C1 feedstocks.

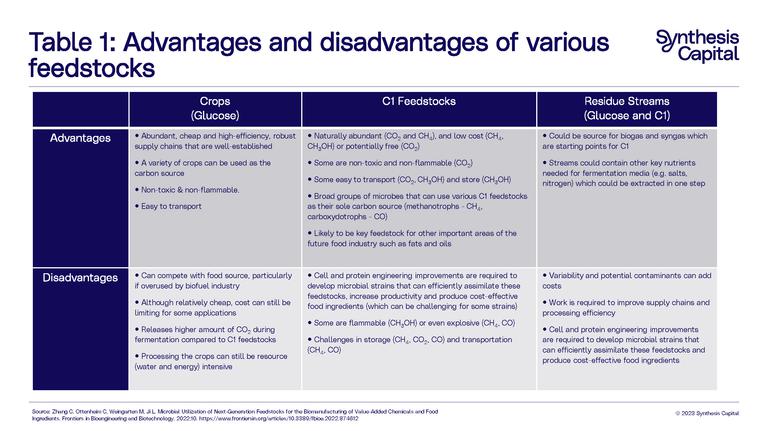

So overall, we group sources for feedstocks for fermentation into three categories: crops grown for feedstock, C1 feedstock, and residue streams (Exhibit 2). Their various potential advantages and disadvantages are laid out in Table 1.[iii] Overall, C1 feedstocks present a serious opportunity, although are marked by differences in the various chemical compounds in terms of cost and safety.

Glucose will remain the primary source of carbon for fermentation in the near to mid term

These feedstocks are a promising alternative carbon source for fermentation produced products. However, for these to be scalable and ubiquitous they still require R&D and investment. Currently we have around 40 companies in our internal pipeline working on alternative feedstocks, including our Synthesis portfolio company Arkeon.

While C1 feedstocks are a particularly promising area, with the add-on benefits of harnessing carbon dioxide, these are still relatively early in their development. In the longer-term we firmly believe the future bioeconomy will utilise both glucose and C1 feedstocks, however in the near-term we expect glucose sourced from crops to be the primary source of feedstock for the growing fermentation market.

So can the global glucose market grow to meet some or all of this demand?

Currently most glucose comes from corn, with various competing end markets

Before tackling this question we need to understand where glucose comes from. Regional glucose production is heavily dependent on specific crops grown in that region. In Asia, glucose is produced predominantly from corn and in Europe from wheat. These are not the only sources, with potatoes, cassava and even biomass residues already being used in glucose production.

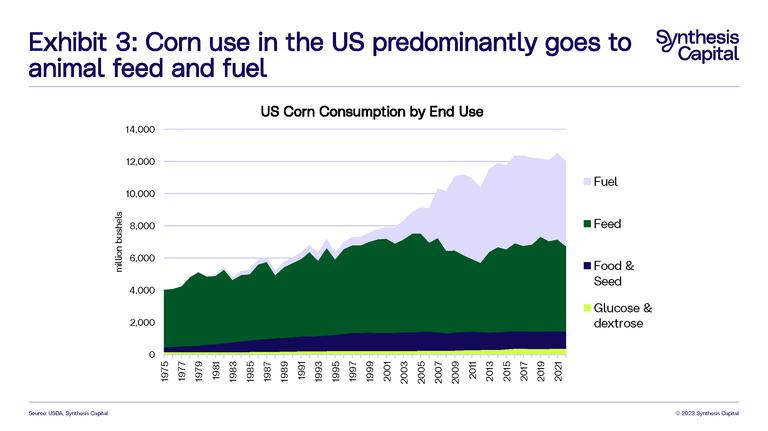

In the US, glucose is produced almost exclusively from corn, through the 150 year old wet-milling process. But glucose is not the primary product derived from US corn. Most of today’s 13 billion bushels actually go towards producing animal feed and fuel. Just 3% (a number that has remained remarkably constant through the last 50 years) currently goes to producing around 6Mt[iv] per annum of glucose and dextrose (a highly purified and crystalline form of glucose) (Exhibit 3). Syrup containing over 90% glucose (a Dextrose Equivalent of 90 or more) is required for most industrial fermentation processes.

In theory this means there is plenty of corn in the US that could be used for glucose production, assuming the processing capacity was there.

Corn has been repurposed in the US before

Currently, there is an adequate supply of glucose in the US for industrial microbial fermentation. However, the huge growth in the bioeconomy means demand for glucose will outpace supply over the next 10-20 years. In our S‑curve analysis of alternative protein adoption, by 2035 we expect 45% of proteins to be produced via alternative methods. This will be a hybrid of recombinant, cultivated, single-cell and plant-based processes. Precision fermentation, single-cell and cultivated processes all utilise glucose as a feedstock.

The good news is that we actually have two key historical comparisons to show that corn can be rapidly repurposed to new and growing end markets and uses. The two products at the heart of it are high fructose corn syrup (HFCS) and bioethanol.

The ramp up of U.S. HFCS Capacity and Production

Today, high fructose corn syrup is the main sweetener made from corn in the U.S. Its production and subsequent growth came about due to breakthroughs in enzyme technology. While technological advancements had led to “traditional” corn syrups with higher and higher glucose concentrations in them, HFCS marked a step change. Production was relatively simple, using an enzyme to increase fructose concentration in glucose syrup.

HFCS was first introduced commercially in 1967 and immediately made an impact due to several favourable and attractive characteristics, compared to the traditional sugar from sugar crops being used at the time. HFCS does not mask fruit flavours, gives a good colour and sheen to products and in liquid form is stable in acidic food and beverages. Because it is a syrup it can be easily transported and transferred between tanks. On top of that, the ability to decouple from volatile sugarcane growing regions was seen as an attractive supply diversifier to the food industry buyers.

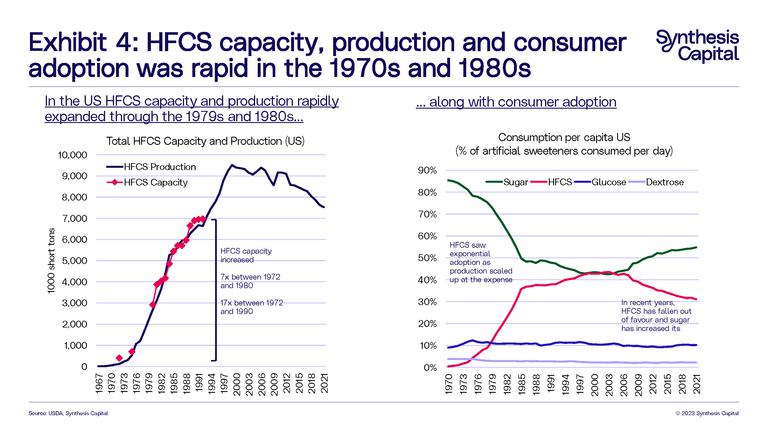

In response to high sugar (and gasoline) prices in the early 1970s, large corn processors, like Archer Daniels Midland (ADM), significantly increased their investment in wet‑milling capacity. However, once crops prices fell back down again to “normal” levels, the wet-millers like ADM could not produce HFCS cheaply enough to compete with cheap sugar imports. This changed when in 1981 the US introduced high sugar import quotas to protect domestic sugar producers from the cheaper foreign sugar producers – effectively creating a price umbrella . It should be noted this was also supported by certain corn wet-millers[v], and unsurprisingly, when the price of sugar in the US subsequently increased, HFCS became the cheaper sweetener. The growth in HFCS capacity, production and importantly consumption took off as a result, with U.S HFCS capacity growing by over 7x between 1972 and 1980 and by over 17x between 1972 and 1990 (Exhibit 4).

By 1984 both Pepsi and Coca-Cola had announced their switch from sugar to HFCS – reducing US consumption of sugar-crops by 500,000 tons per year in one fell swoop.[vi]

Bioethanol Production

The rise of the US’s bioethanol industry is rooted in the same corn subsidies that led to the growth in HFCS. Biofuel growth in the US continued as various government policies and programs (mainly aimed at reducing fossil fuels in transportation) were introduced, starting with the Clean Air Act in 1970.[vii]

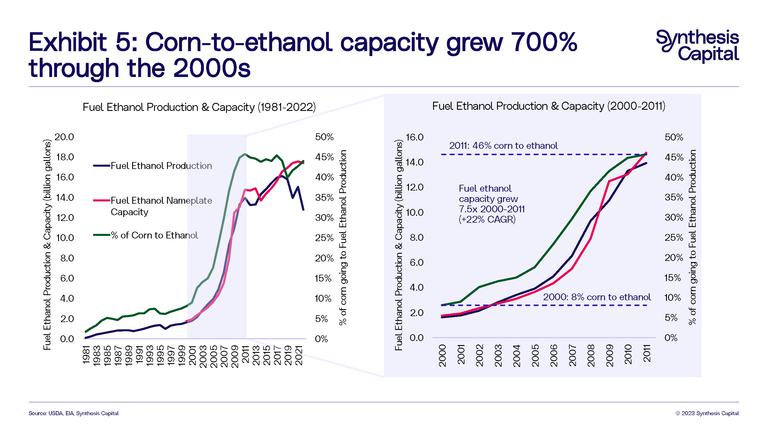

However, the introduction of the Volumetric Ethanol Excise Tax Credit (VEETC) for blending ethanol into motor gasoline from 2005 through 2011, coupled with the Energy Policy Act (EPACT) and Renewable Fuel Standards (RFS) in 2006, is generally credited with driving the seven-fold expansion in biofuel production and consumption through the 2000s.[viii]

The capacity expansion for fuel ethanol was significant, with annual capacity additions averaging over 2 billion gallons per year between 2007-2011. The percentage of corn going to ethanol production went from 8% of supply in 2000 to 46% in 2011 – equalling the amount of corn that goes to animal feed in the US (Exhibit 5).

Today the corn that goes to produce fuel ethanol in the US annually could feed 7.2 billion people – almost the global population.[ix]

So can glucose expand capacity and production?

The takeaway from the growth in HFCS and bioethanol capacity is the read across for potential glucose capacity. Assuming capacity scales up at the same rates as for biofuels and HFCS (we estimate 7x by 2030), we could expect glucose production from corn alone of 38Mt in the US by 2030 and 100Mt globally. Globally, this is above what our Synthesis S-curve predicts we’ll need in 2030 (59Mt).

While there may be precedent for this shift in end-use of corn in the US, it of course relies on the incumbent glucose producers investing in the protein transition in a big way. Catalysts to this could be the renewable energy transition resulting in less demand for biofuels and the growth in alternative proteins resulting in less animal feed. But nothing is set in stone.

This still won’t be enough for the protein disruption – alternatives are key

Glucose is nature’s most abundant monosaccharide (the simplest form of carbohydrates) and will be a key feedstock of the future; there is no doubt about that. However, for a true protein transition, alternative feedstocks will be required.

Companies are working on this from a variety of angles. Multiple companies – including Synthesis portfolio company Arkeon – are developing fermentation platforms that assimilate alternative feedstocks to produce a range of amino acids, proteins, and fats. Companies harnessing microbes that can use C1 feedstocks (like Arkeon) have seen increasing interest from investors over the last few years.

In addition, more recently we have seen companies focusing on side stream utilisation, from food and agricultural waste, waste water, or even upcycling from other parts of the supply chain. As we strive towards a more circular economy, being able to capture usable feedstock from waste will be an important aspect of the supply chain.

While these are the current opportunities, we expect more to develop. Going forward, key focus areas include thinking about how to incorporate these alternative feedstocks for cultivated meat production, as well as capitalising on other sources that we haven’t necessarily discussed here (for example microalgae or even breeding crops with higher glucose content specifically for glucose production).

In conclusion, the scale and resilience of the future alternative protein industry and broader bioeconomy necessitates a system where we have a variety of types and sources of feedstocks. On top of this, making sure we intelligently use all potential carbon sources in our future food system will be a vital area for focus. As such at Synthesis we remain focused on alternative feedstocks as an investment area.

References

[i] Glucose is a monosaccharide with the molecular formula C6H12O6. It exists in two enantiomeric – or mirror image – forms: L‑glucose and D-glucose. It is the D-glucose form that is known as dextrose. The D-isomer, dextrose, occurs widely in nature, but L-glucose does not. As such we use glucose and dextrose interchangeably. Generally the name used will depend on the use. For example in commercial and industrial usage the term dextrose will be used, whereas everywhere else D-glucose will be called glucose.

[ii] FAOStat and USDA

[iii] Zhang C, Ottenheim C, Weingarten M, Ji L. Microbial Utilization of Next-Generation Feedstocks for the Biomanufacturing of Value-Added Chemicals and Food Ingredients. Frontiers in Bioengineering and Biotechnology. 2022;10. Link here.

[iv] USDA ERS, Sugar and Sweeteners Yearbook Tables. Accessed here February 2023

[v] ADM was led by Dwayne Andreas at the time who was a supporter of the Florida sugarcane growers’ lobbying efforts to introduce a foreign-grown sugar import quota, and a close ally of President Ronald Reagan. This excellent article covers some of the key machinations at the time. (Mother Jones, retrieved February 2023)

[vi] James Bovard writes “On November 6, 1984, both Coca Cola and Pepsi announced plans to stop using sugar in soft drinks, replacing it with high-fructose corn syrup…U.S. sugar consumption decreased by more than 500,000 tons a year—equal to the entire quotas of 25 of the 42 nations allowed to sell sugar in the United States” (1998, 2).

[vii] The Clean Air Act (CAA) of 1970 defines the U.S. Environmental Protection Agency's (EPA) responsibilities for protecting and improving air quality.

[viii] There is some dispute about this in the literature for example: E. Newes, Ethanol production in the United States: The roles of policy, price, and demand, Energy Policy (2022). A copy can be accessed here.

[ix] Based on global average corn per capita for food consumption of 18.5 kg/capita/year from FAOStat and 5,275 million of bushels going to fuel ethanol from the USDA. Data can be found in Erenstein, O., Jaleta, M., Sonder, K. et al. Global maize production, consumption and trade: trends and R&D implications. Food Sec. 14, 1295–1319 (2022). Link here.